AI vs Traditional Fraud Detection: Key Benefits & Insights

Published: 25 Mar 2025

Fraud is a big problem in today’s digital world. Businesses lose billions of dollars every year due to fraud. That’s why fraud detection is important. It helps companies identify and stop fraudulent activities before they cause damage.

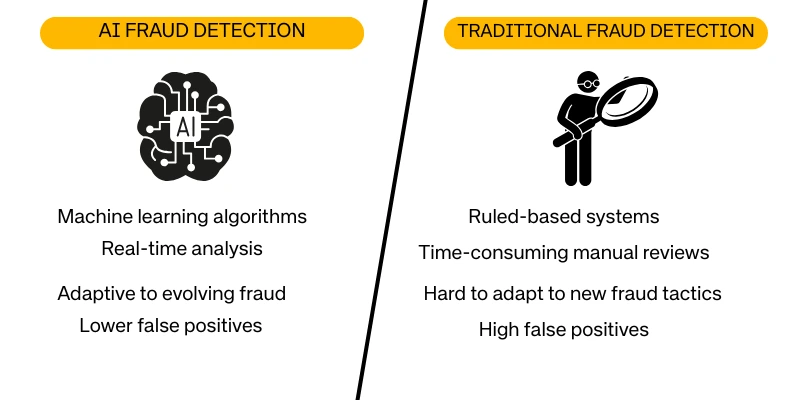

There are two main ways to detect fraud: traditional fraud detection and AI-powered fraud detection. Traditional methods rely on fixed rules and human reviews, while AI uses machine learning to spot fraud in real-time.

In this blog, we will compare both methods. You’ll learn how they work, their pros and cons, and which one is better for modern fraud prevention. Let’s dive in!

Table of Contents

Understanding Traditional Fraud Detection

Fraud detection is essential for businesses, banks, and online platforms. Before AI, companies used traditional fraud detection methods to catch suspicious activities. These methods rely on fixed rules and human reviews. Let’s explore how they work and their limitations.

What Is Traditional Fraud Detection?

Conventional fraud detection relies on predefined rules to identify suspicious activities. Businesses set fixed rules to flag transactions or activities that seem unusual. For example:

- If a credit card transaction exceeds $5,000, it gets flagged.

- If a user logs in from a new country, they must verify their identity.

Along with these rules, businesses use manual reviews. Fraud analysts check flagged transactions to decide whether they are genuine or fraudulent.

How Traditional Fraud Detection Works

Traditional systems work by comparing new transactions with predefined fraud patterns. Here’s an example:

A bank sets a rule: Flag any transaction above $10,000.

A customer makes a $12,000 purchase online.

The system flags the transaction for manual review.

A fraud analyst checks the details and either approves or blocks it.

This method is simple and easy to apply, but it has major drawbacks.

Limitations of Traditional Fraud Detection

Despite being widely used, traditional fraud detection has some weaknesses:

Slow Process

- Since humans manually review flagged transactions, the process takes time.

- Delays can frustrate customers who are making legitimate purchases.

High False Positives

- Many real transactions get wrongly flagged as fraud.

- Example: A customer travels abroad and makes a purchase. The system blocks their card even though it’s them.

Inability to Detect New Fraud Tactics

- Fraudsters keep changing their methods. Fixed rules may not catch new fraud patterns.

- Example: A hacker mimics normal user behavior to bypass detection. Since the system follows old rules, it may not notice the fraud.

Traditional fraud detection has worked for years, but its slow speed, high error rate, and lack of adaptability make it less effective against modern threats. That’s where AI fraud detection comes in, offering a smarter approach.

Understanding AI-Powered Fraud Detection

What Is AI Fraud Detection?

AI fraud detection is the use of artificial intelligence (AI) and machine learning (ML) to identify fraudulent activities. Instead of relying on fixed rules, AI analyzes large amounts of data to detect suspicious patterns.

Traditional fraud detection uses predefined rules, like blocking transactions over a certain limit. AI, however, learns from data and adapts over time. It finds hidden fraud patterns that traditional methods may miss.

AI fraud detection uses:

- Machine learning (ML): Learns from past fraud cases to detect new ones.

- Automation: Reduces the need for human intervention.

- Real-time analysis: Detects fraud instantly instead of after it happens.

For example, if a bank customer suddenly withdraws a large amount from a new location, AI checks if this matches the user’s normal behavior. If not, it flags the transaction as suspicious.

How AI Fraud Detection Works

AI fraud detection works by analyzing thousands of transactions per second to find fraud patterns. It looks at user behavior, transaction details, and historical fraud data to make decisions.

Here’s how it works:

- Data Collection: AI gathers data from transactions, user activity, and devices.

- Pattern Recognition: It compares new transactions with normal behavior.

- Anomaly Detection: If a transaction is unusual, AI flags it for review.

- Real-Time Action: The system either blocks the transaction or asks for verification.

Example: A credit card company uses AI to detect fraud. If a customer regularly shops in Pakistan but suddenly makes a large purchase in another country, AI sees this as unusual and alerts the user instantly.

AI also uses:

- Machine learning models to improve accuracy over time.

- Deep learning to detect complex fraud attempts, like identity theft.

Advantages of AI in Fraud Detection

AI-powered fraud detection is more efficient and accurate than traditional methods.

✅ Faster Detection

- AI scans transactions in real time, stopping fraud before it happens.

- Traditional systems rely on manual reviews, which take time.

✅ More Accuracy

- AI learns from past fraud cases and adapts to new fraud tactics.

- It improves over time, reducing errors.

✅ Lower False Positives

- AI understands normal vs suspicious behavior better.

- Traditional fraud detection often blocks legitimate transactions by mistake.

Example: An e-commerce site using AI fraud detection saw 30% fewer false positives, meaning fewer frustrated customers.

AI vs Traditional Fraud Detection: A Comparison

| Feature | Traditional Fraud Detection | AI Fraud Detection |

| Speed | Slow (manual reviews) | Fast (real-time detection) |

| Accuracy | High false positives | More accurate predictions |

| Adaptability | Fixed rules | Learns and evolves |

| Efficiency | Labor-intensive | Automated and scalable |

Real-World Examples of AI in Fraud Detection

AI is already helping businesses detect and prevent fraud more efficiently. Let’s look at how major companies use AI to stop fraudulent activities.

How Banks Like JP Morgan and PayPal Use AI for Fraud Prevention

Banks and payment platforms handle millions of transactions daily. Fraudsters try to trick these systems using stolen credit cards, fake identities, or suspicious transactions. AI helps detect and prevent these frauds faster than traditional methods.

✅ JP Morgan:

JP Morgan uses AI and machine learning to scan millions of transactions in real time. Their AI system analyzes patterns to identify unusual behavior. For example, if a customer usually shops in the U.S. but suddenly makes a high-value purchase in another country, AI flags the transaction. The bank then asks the customer for verification before approving it. This prevents unauthorized transactions and protects customers.

✅ PayPal:

PayPal handles billions of online payments every year. AI helps detect fraud by learning from past transactions. It analyzes customer behavior, purchase history, and location data. If someone’s account suddenly makes a large transaction from a new location, AI can block it instantly. PayPal’s AI has reduced fraud cases while ensuring that real customers don’t face unnecessary transaction blocks.

Example: How an E-Commerce Site Reduced Chargeback Fraud Using AI

Chargeback fraud happens when a customer buys something online, then falsely claims they never received the item to get a refund. This costs businesses a lot of money.

An online fashion retailer struggled with high chargeback fraud rates. Customers would buy expensive clothing, wear it, and then request a refund, claiming they never got the item. The store started using AI-powered fraud detection.

Here’s how AI helped:

- AI analyzed customer behavior—if someone frequently filed chargebacks, it flagged them as high-risk.

- AI monitored delivery tracking data—it checked if the item was delivered before approving refunds.

- AI detected suspicious transactions—if someone used multiple credit cards for purchases, AI flagged them for review.

After implementing AI, the retailer reduced chargeback fraud by 40% and saved thousands of dollars in losses.

Challenges of AI in Fraud Detection

AI fraud detection is powerful, but it has challenges. Let’s look at three major ones.

AI Needs High-Quality Data for Training

AI learns from data. If the data is incomplete, outdated, or biased, AI may not work properly. For example, if a bank’s fraud detection system is trained only on past fraud cases from one country, it may fail to detect fraud in another region.

Solution: Businesses must feed AI with diverse and up-to-date data to improve accuracy.

Expensive to Implement for Small Businesses

AI systems require advanced technology, skilled experts, and continuous updates. Large companies like PayPal and Amazon can afford this, but small businesses may struggle.

Solution: Many cloud-based AI fraud detection tools offer affordable plans for small businesses. These tools provide AI-powered protection without huge costs.

Potential Biases in AI Models

AI makes decisions based on the data it’s trained on. If the data has biases, AI may unfairly target certain groups or miss certain fraud patterns. For instance, if AI is trained mostly on fraud cases involving young users, it might fail to detect fraud by older users.

Solution: Businesses must regularly audit and improve AI models to reduce biases and ensure fairness.

AI fraud detection is not perfect, but with proper data, affordable solutions, and regular monitoring, businesses can overcome these challenges.

Future of Fraud Detection: AI Leading the Way?

Fraud tactics are getting smarter every day. Cybercriminals constantly find new ways to bypass security systems. This raises an important question—will AI completely replace traditional fraud detection?

Will AI Replace Traditional Fraud Detection Completely?

AI fraud detection is faster, smarter, and more efficient than traditional methods. It can instantly identify fraud, minimize false alarms, and adjust to emerging fraud tactics. Many companies already rely on AI to protect their systems.

However, AI is not perfect. It needs high-quality data to work correctly. If the data is biased or incomplete, AI may make mistakes. Also, small businesses may struggle with the high cost of AI implementation.

Because of these challenges, traditional fraud detection still plays a role. Some businesses use a hybrid approach, combining AI with human review and rule-based methods. This way, AI detects suspicious activities, and humans make the final decision in complex cases.

How AI Is Evolving to Fight Advanced Fraud Tactics

Fraudsters are using AI-powered attacks, deepfakes, and automated scams. To stay ahead, AI fraud detection is evolving with:

- Self-learning algorithms – AI models that improve themselves over time.

- Behavioral analysis – AI tracks user behavior and spots unusual patterns.

- Deepfake detection – AI identifies fake voices and images used in scams.

- Real-time response – AI reacts instantly to stop fraudulent transactions.

As AI technology improves, fraud detection will become more accurate, faster, and harder to bypass. While traditional methods may not disappear completely, AI is clearly leading the way.

FAQs (Frequently Asked Questions)

Can AI completely stop fraud?

No, AI cannot completely eliminate fraud, but it can significantly reduce risks. Fraudsters constantly develop new tactics, and while AI is great at detecting suspicious activities, it is not foolproof. However, AI-powered fraud detection improves security by analyzing large amounts of data, identifying unusual behavior, and adapting to new fraud patterns.

Is AI fraud detection expensive?

It depends on the business size and the system used. Large financial institutions and e-commerce platforms invest in advanced AI solutions that can be costly. However, many affordable AI-based fraud detection tools are available for small and medium businesses. Cloud-based AI services provide cost-effective options that charge based on usage, making them more accessible.

Can small businesses use AI for fraud detection?

Yes, small businesses can use cloud-based AI fraud detection solutions without needing huge budgets or complex IT setups. Many providers offer plug-and-play AI tools that integrate with payment gateways, banking systems, or e-commerce platforms. These tools analyze transactions in real time, helping small businesses detect and prevent fraud quickly.

Conclusion

Fraud detection is critical for businesses, banks, and online platforms. Traditional fraud detection has been useful for years, relying on fixed rules and manual reviews. However, it struggles with speed, accuracy, and adaptability.

AI-powered fraud detection changes the game. It works in real-time, learns from new fraud patterns, and reduces false positives. Businesses using AI can detect threats faster and with better accuracy.

That said, traditional methods still have their place. In some cases, a mix of both AI and rule-based detection works best. AI can handle complex fraud cases, while human oversight can fine-tune the system.

For businesses, the future is clear—AI is the smarter choice. It helps prevent fraud efficiently, protects customer trust, and keeps financial losses low. If you want stronger fraud protection, AI is the way forward.